As a work at home mom of three, I’ve had to make choices that I believed were for the betterment of my family. Money does make the world go round but family, love and support are at its core. I’ve had how many people tell me that I could be having a stellar career or making a mark but I preferred to choose work that would allow me to see my kids and be there for them. That’s my choice.

That choice hasn’t come without some hardships though. Evening out the balance is the fact that I don’t earn as much as I could. I earn enough to support my kids and live semi comfortably. This is today. A few years back it was a whole another story. It’s always been my goal to gain financial freedom. Little by little I am and with my Avida financial guide I’ve been able to turn things around and have us at a comfortable level.

Financial freedom starts with a goal. My goal is to be able to maintain my current output which allows me to pay for the bills and put my kids through school. If I can up the ante and be able to give my family wants and needs then all the better.

What’s helped me the most was to identify my expenses and plan ahead. From electricity to entertainment, I try and anticipate costs. I allow myself leeway sometimes but I’m a stickler for keeping to a schedule and making sure all my payments are current.

Can you believe I don’t even have a credit card? My thinking is if I can’t afford to pay cash then I can’t afford it at all.

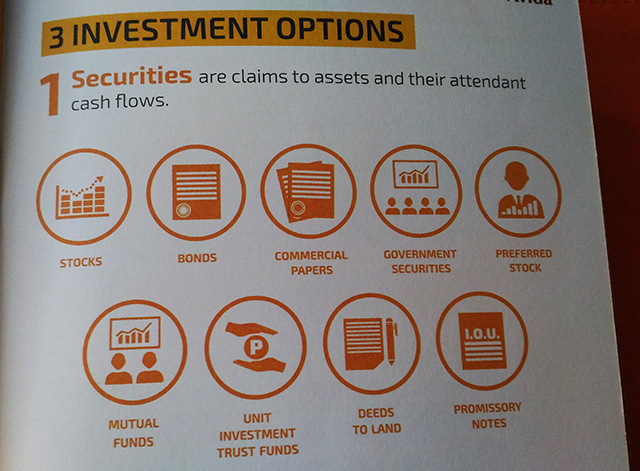

The one thing I’ve been looking at lately is investing. It doesn’t seem enough to just keep up with all my expenses. I want to be able to have some security for my kids and the best option is investing. With my Avida planner I have a better understanding of my options. To be honest, it can get a little confusing!

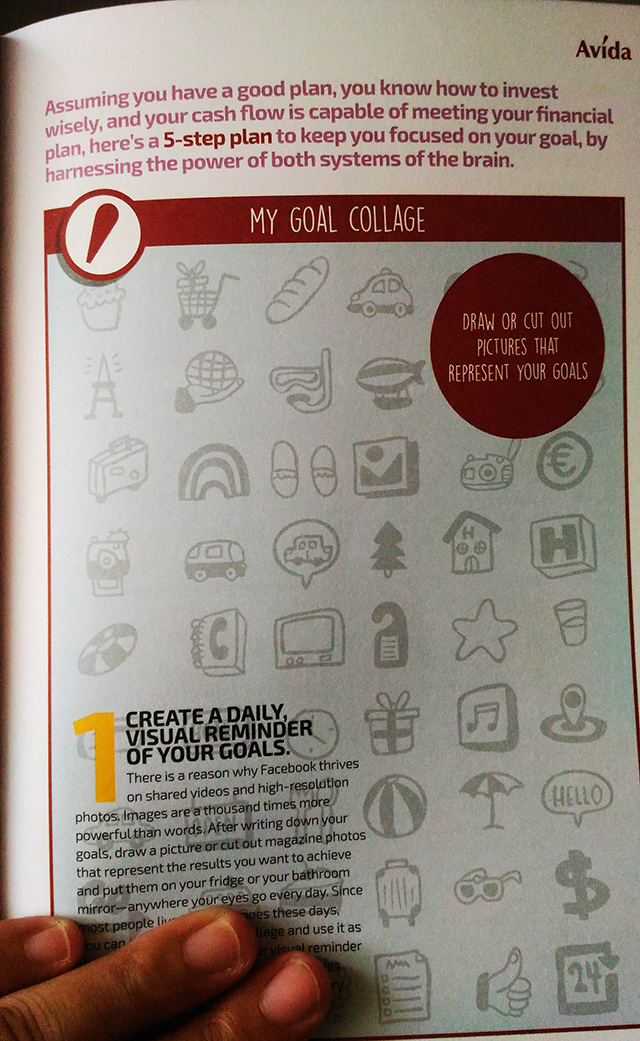

I’m a very visual person. I like seeing my achievements especially when I’m able to mark something as done or completed. A perfect suggestion from my planner is a Goal College. You can make your own collage on a bulletin board or even on illustration board. Tack up pictures of your goals. You can start with a 1 year period up to however long you like. It can give you great inspiration in trying to achieve them.

I think the most important thing is to be decided. From there you can plan your goals and slowly achieve financial freedom.

Copyright secured by Digiprove © 2016

Copyright secured by Digiprove © 2016